News

Introduce more taxes, Ghana is broke – Joe Jackson tells Govt

Published

3 years agoon

By

Vida Essel-Lamptey

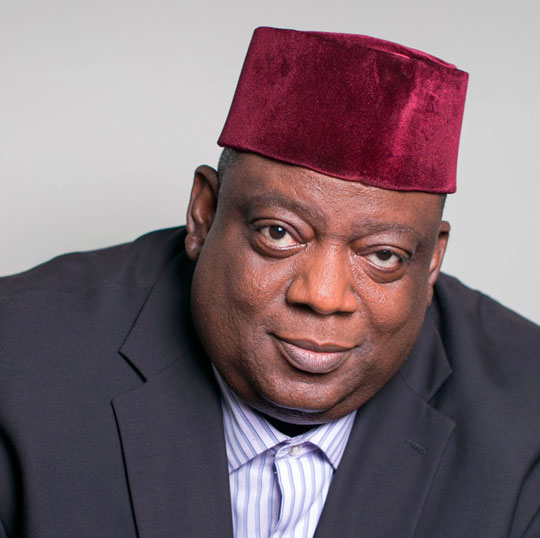

A Financial Analyst and the Chief Operating Officer of Dalex Finance, Mr Joe Jackson has urged the government to introduce more taxes, especially, on the rich in the Ghanaian society to enable the government gather funds to undertake development projects in the country.

He said unless government increases tax revenues generated internally, the country may not be able to borrow more to fund its projects.

In a twitter post sighted by GhanaPlus.com on Monday, May 17, Mr Jackson wrote, “Ghana is broke! We spend 49.5% of revenue on interest payments. Govt needs to increase tax revenue else we may not be able to even borrow more”.

He added that the 2021 budget presented by the Leader of government business and Majority Leader of Parliament, Mr Osei Kyei Mensah-Bonsu took the easy way out by imposing direct taxes which generally affect the poor and advised the rich should be tax rather.

“This budget takes the easy way out by imposing indirect taxes which affect the poor more than the wealthy. #TaxTheWealthy #HardDecisions,” he said.

Ghana is broke! We spend 49.5% of revenue on interest payments. Govt needs to increase tax revenue else we may not be able to even borrow more. This budget takes the easy way out by imposing indirect taxes which affect the poor more than the wealthy. #TaxTheWealthy #HardDecisions pic.twitter.com/sa5LskmTAT

— Joe Jackson (@Joe_Jackson_GH) March 17, 2021

His comments come after Parliament passed the the country’s tax laws and amendments bill to make room for taxes imposed by the government in the 2021 budget.

The new taxes include the COVID-19 Health Recovery Levy Act, 2021, Act 1068; Penalty and Interest Waiver Act, 2021, Act 1065; Income Tax (Amendment) Act, 2021, Act 1066; Energy Sector Levies (Amendment) Act, 2021, Act 1064; Ghana Infrastructure Investment Fund (Amendment) Act, 2021, Act 1063

“To provide the requisite resources to address these challenges and fund these activities, government is proposing the introduction of a Covid-19 Health Levy of a one percentage point increase in the National Health Insurance Levy and a one percentage point increase in the VAT Flat Rate to support expenditures related to Covid-19,” the budget statement for the 2021 fiscal year said.

The taxes, according to government were to enable the country deal with the effects of the Coronavirus pandemic which hit the world in December 2019 and in the country on March 2021.

Source: GhanaPlus.com

You may like

-

Mahama leads NDC to mourn with Kufuor over wife’s passing

-

Former First Lady of Ghana Theresa Kufuor reported dead

-

The most powerful tool for change is the right to vote – Mahama

-

PFJ was a mere state resource looting platform – Minority

-

ECOWAS is desecrating Ghana

-

Prof Gyampo elected President of UTAG, University of Ghana branch

Mahama leads NDC to mourn with Kufuor over wife’s passing

Former President John Dramani Mahama on Wednesday, October 4 led a delegation from the National Democratic Congress (NDC) to visit...

Former First Lady of Ghana Theresa Kufuor reported dead

The former First Lady of Ghana and wife of Ghana’s former President, John Agyekum Kufour, Mrs Theresa Kufuor has been...

The most powerful tool for change is the right to vote – Mahama

The 2024 flagbearer of the National Democratic Congress (NDC), John Dramani Mahama, is rallying Ghanaains who have grown disillusioned with...

PFJ was a mere state resource looting platform – Minority

The Minority has descended heavily on the Akufo-Addo-led government for launching a second phase of the flagship Planting for Food...

ECOWAS is desecrating Ghana

The Director of Legal Affairs of the National Democratic Congress (NDC), Mr Abraham Amaliba has said the Economy Community of...

Prof Gyampo elected President of UTAG, University of Ghana branch

A Senior Lecturer at the Political Science Department of the University of Ghana (Legon), Prof Ransford Gyampo have been elected...